In just six months, Blur, a small startup co-founded by 24-year-old Tieshun Roquerre and Anthony Liu (known as “Galaga” online), has managed to dethrone OpenSea as the largest marketplace by trading volume for NFTs. Blur’s success can be attributed to several factors, including its different approach to the NFT market and its focus on active traders.

The strategy

While OpenSea caters to retail NFT buyers and art aficionados, Blur has taken a different path, reminiscent of Robinhood’s growth strategy. By targeting active NFT traders, Blur undercuts its competitors by charging no platform fees and funding its business with venture capital from crypto investors like Paradigm and Cozomo de Medici. Blur also rewards its customers with its own self-minted coin, a move that OpenSea has not yet adopted. This approach has been particularly effective as casual NFT buying by retail customers and collectors has largely evaporated, leaving active traders as the primary market for NFT platforms.

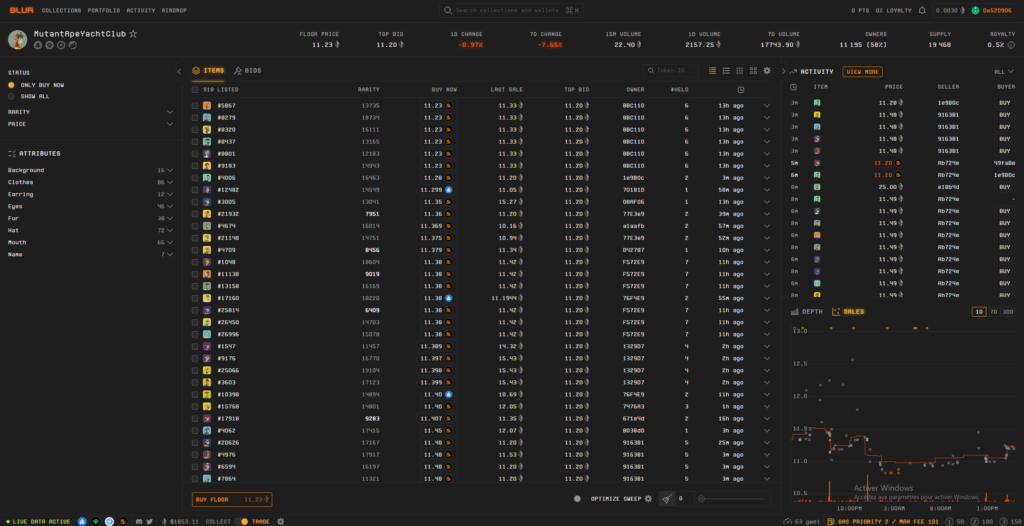

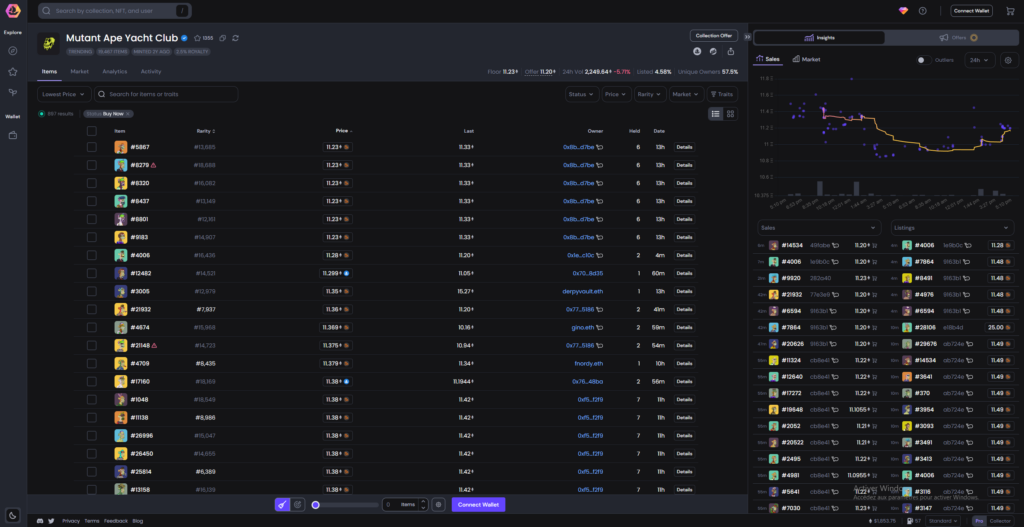

Blur’s user interface is designed to cater to traders, with a simple, stock-trading-inspired layout that emphasizes trading data and makes it easy to buy and sell NFTs in bulk. This is a significant departure from the gallery-style interface of OpenSea, which focuses on the visual aspects of NFTs.

Royalties and controversy

Another controversial tactic employed by Blur was making royalty payments to artists optional. This move led to OpenSea lowering its royalties, and both marketplaces eventually agreed to a minimum royalty fee of 0.5%.

The rapid rise of Blur has had a significant impact on the NFT market. In response to Blur’s success, OpenSea temporarily eliminated its 2.5% platform fee and launched OpenSea Pro, a trading platform with 0% fees and similar trading tools as Blur.

No fees, no revenues?

Despite Blur’s success, the startup faces several challenges, including its lack of fees, which means it relies on its $11 million in venture capital funding. In August, Blur’s token holders will vote on a proposal to introduce a 2.5% platform fee. However, if implemented, this could lead to a loss of users. Furthermore, the platform has faced backlash from NFT artists due to its initial decision to cut out royalties for creators. Finally, potential regulation by the SEC could impact the NFT market and Blur’s reward tokens.

As the NFT trading landscape continues to evolve, it remains to be seen how Blur will adapt and maintain its market dominance while navigating the challenges it faces. Regardless, its innovative approach to trading and its rapid rise to success provide valuable insights into the rapidly changing world of NFTs.