Non-fungible tokens (NFTs) have taken the digital asset world by storm, drawing attention from artists, collectors, and investors alike. To make the most out of this burgeoning market, it’s essential to understand the hype and value cycles that drive NFTs. Let’s delve into the key aspects that shape these cycles and learn how to navigate them effectively.

The Hype Cycle: Peaks and Troughs

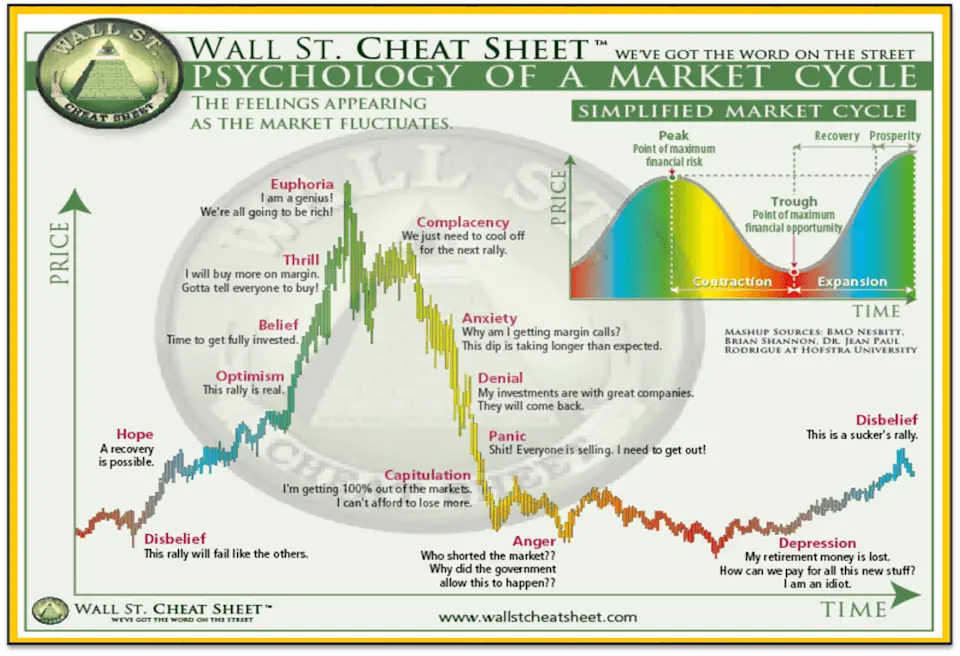

The hype cycle is a pattern often observed in emerging technologies, including NFTs. It starts with an innovation trigger that captures the public’s imagination, leading to a rapid increase in interest and investment. This intense focus causes inflated expectations, which eventually results in a peak of inflated expectations.

As reality sets in, disillusionment follow, causing a decline in interest and value. The trough of disillusionment represents the lowest point in the cycle. However, it’s essential to note that this isn’t the end. Technologies that can demonstrate real-world value will gradually climb the slope of enlightenment, ultimately reaching a plateau of productivity where their true potential is realized.

The Value Cycle: Growth and Consolidation

While the hype cycle focuses on the attention a technology receives, the value cycle concerns the actual value it generates. This cycle consists of two primary phases: growth and consolidation. During the growth phase, new projects and innovations emerge, attracting significant investments. The consolidation phase follows, wherein weaker projects fade away, and stronger ones continue to develop, leading to market stability.

Understanding the relationship between the hype and value cycles is crucial for investors and enthusiasts alike. Recognizing when a technology is at the peak of inflated expectations or in the trough of disillusionment can help identify potential investment opportunities or avoid ill-timed decisions.

Navigating the Cycles: Strategies for Success

To navigate the hype and value cycles of NFTs effectively, consider adopting the following strategies:

- Stay informed: Keep up-to-date with the latest NFT trends, technologies, and platforms. Being well-informed can help you identify opportunities and avoid potential pitfalls.

- Diversify your portfolio: As with any investment, it’s essential to diversify your NFT holdings. This can help mitigate risks associated with specific projects or market segments.

- Look beyond the hype: Don’t get swept away by the hype surrounding NFTs. Instead, focus on the underlying value of the projects and assets you invest in.

- Be patient: Navigating the cycles of hype and value requires patience. Don’t expect immediate returns on your investments. Instead, adopt a long-term perspective, and be prepared to weather the ups and downs of the market.

In conclusion, understanding the hype and value cycles of NFTs is crucial for making informed decisions in this dynamic market. By adopting the strategies outlined above and staying informed about the latest developments, you can position yourself for success in the ever-evolving world of digital assets.